Business Insurance in and around Springfield

One of the top small business insurance companies in Springfield, and beyond.

This small business insurance is not risky

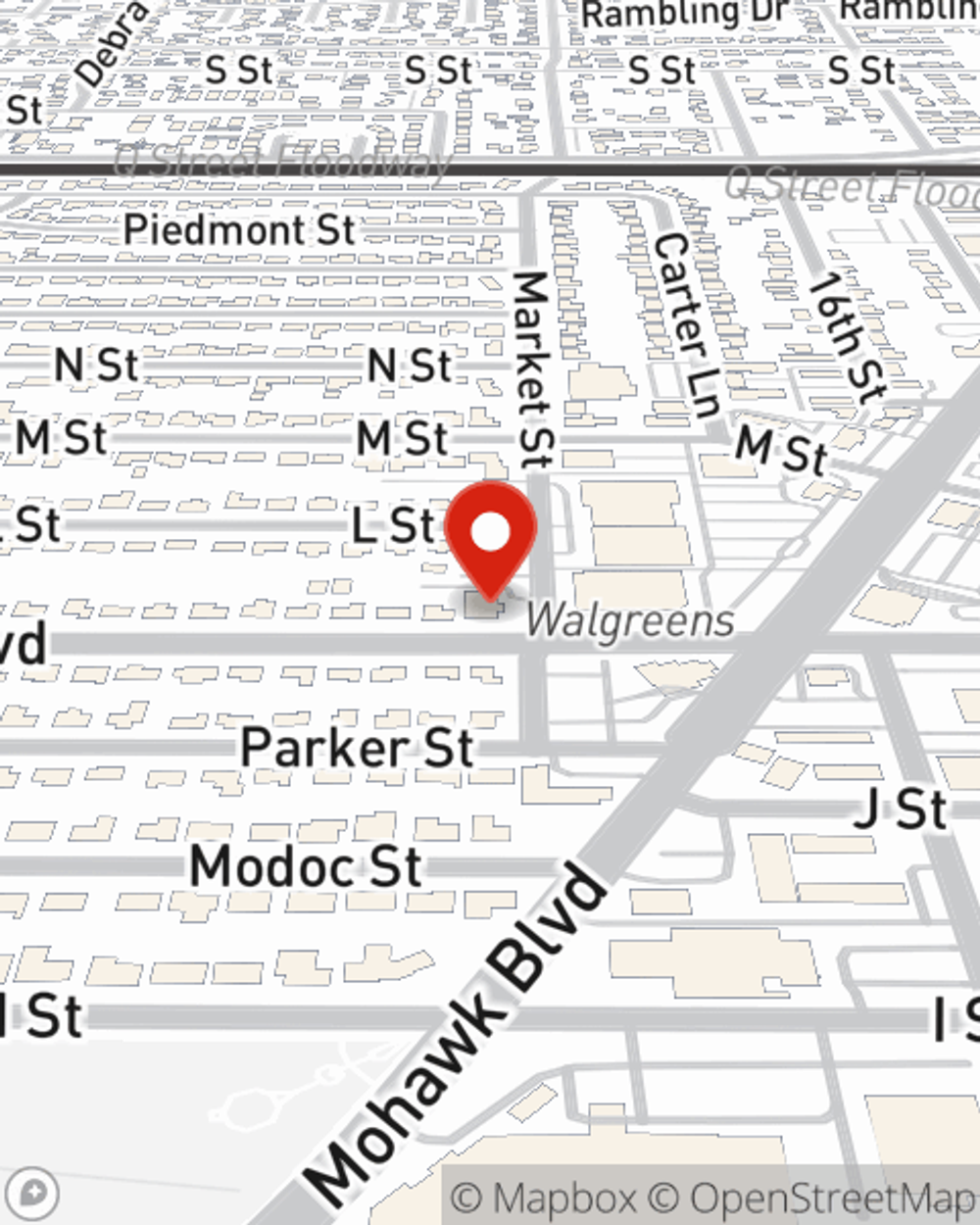

- Eugene, OR

- Creswell, OR

- Cottage Grove, OR

- Coburg, OR

- Roseburg, OR

- Albany, OR

- Corvallis, OR

- Salem, OR

- Bend, OR

- Redmond, OR

- Sisters, OR

- Prineville, OR

- Portland, OR

- Medford, OR

Help Protect Your Business With State Farm.

Small business owners like you have a lot on your plate. From social media manager to product developer, you do as much as possible each day to make your business a success. Are you a podiatrist, an optician or a painter? Do you own a shoe repair shop, a cemetery or a bridal shop? Whatever you do, State Farm may have small business insurance to cover it.

One of the top small business insurance companies in Springfield, and beyond.

This small business insurance is not risky

Cover Your Business Assets

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent David Hersch. With an agent like David Hersch, your coverage can include great options, such as business owners policies, commercial liability umbrella policies and artisan and service contractors.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent David Hersch's office today to discuss your options and get started!

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

David Hersch

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.